More of a curiosity than a full-blown article, but I was mining a cryptocurrency for a while this week on an average computer. I mean, a long time ago, when Bitcoin was worth so much as nothing, I mined Bitcoins too. This week I just happened to have a computer with a good CPU, average graphics card and free electricity. I thought I’d see how it works today, just for old times’ sake.

But it all started somewhere around the end of 2009 and I played around with it until about 2014. I was mining Bitcoins using some GPUs from work and on some dedicated equipment or USB sticks farm etc. I never invested too much in it, but I had a lot of friends who started making real investments and they always shared some equipment with me in exchange for technical support. I remember the days when Bitcoin mining was almost as crazy as gold fever. How the first payments appeared. How the exchange rate went from zero to a few cents, then to a few dollars, then to hundreds and thousands of dollars.

I had a few Bitcoins when they were worth nothing, only to think long and hard about how much to sell, how much to invest and how much to keep for better times when Bitcoin was worth a dozen dollars. When the price went crazy in 2013, from a few hundred dollars to a few thousand dollars per Bitcoin, I thought the world had gone crazy. At the time I sold most of it to fix my old car, furnish my new apartment and spend on other needs while enjoying the easy money. I sold the rest in 2014, when prices dropped drastically and I thought crypto was at the end of its journey. I was wrong :)

When I later calculate how much money I would have had if I still had all those Bitcoins, or if I had kept even one, I sometimes feel regret. But those were crazy years, both in my life and in cryptocurrency. Nobody knew anything, lots of speculation, as many opinions as people. In the end, I don’t regret anything because I earned my money and it helped me in a way to become who I am today and the joy of having a lot of money from literally nothing at that time was huge. I also mined Doge coins, which also made me some money, but it was already small, I didn’t keep it until 2017 when the big cryptocurrency bubble happened.

After that, cryptocurrencies were always present in my life, some people paid me this way for services and technical expertise. This is still the case today. I also accept a donation this way, I pay for some domains and servers this way. At a time when people were less aware of wallets and their security, it was easier (generally difficult, but with some luck it was worth the time spent searching) to search the internet for wallet files, which often turned out to be insecure or with easily crackable passwords. Nowadays there are no wallets without passwords and most of them are hardware wallets. I also use referral links to various exchanges and it is possible to make money from this too.

That, more or less, is the short but fun story of my cryptocurrency mining. To this day, I still have a gadget from that time in my drawer. The only use it has now is as a key ring. In general, it was a bad gadget that was used to trick people into buying such gadgets for big bucks, then cost about $10 and gave false hope of mining to people who had no idea about it.

333 MH/s USB Bitcoin Miner xD.

I’ve never been an expert in this field, I’ve just been lucky enough to deal with people who could invest in it but needed someone to advise them sometimes or help them cheaper than a professional service. Some of them made a lot of money, some of them got lost in the investment and eventually overspent on equipment that could not keep up with the competition. But all of them learned something, me too. I continued to make money from airdrops in my later days. I learned from experience, took part in every giveaway I could, waited a few years and sold what I got for free for a few hundred dollars. It cost me nothing but patience. I knew, however, that nothing like Bitcoin would ever happen again, to shoot up from a few dollars to tens of thousands of dollars in such a short time. I even shared information about Stellar Lumens Airdrop. To help other people earn some money. It was easy to create a few accounts and then move all the coins into a wallet I have for the day (1859 XLM). One XLM is now worth 0.111651 USD, so I have about 200 USD for free. At the end of 2019 it was around 0.0047 USD (my balance at the time: ~8 USD). On 17 May 2021 it was 0.71 USD (my balance at the time: ~1319 USD). That’s the only Airdrop I still have from 2019 until today, so you can check prices over the time. Was there a better time to sell? Of course there was! Is there a chance that better times will come for Stellar? Of course there is! Is there a chance that I will live to see them? Of course not! In this one case, I left myself some of this cryptocurrency to see what happens in 20 years when it’s worth, say, a million. Lol.

There are so many cryptocurrencies these days, they come and go so quickly, or are dead, that to keep track of them all and make money, you would have to be in it 24 hours a day, trading cash all the time. Almost like a regular stock market.

For fun, I took 3 cryptos as an example and mined them using pools for a while. Don’t take this seriously or as an incentive to mine crypto coins or as a professional measure. The results themselves should convince you and illustrate the scale of the equipment required and the size of the earnings. There are also lots of cool online calculators that take into account equipment, electricity prices, efficiency and estimated income, so you can see that if you’re not going to do it professionally, it’s not worth starting. If you are interested in mining cryptocurrencies at home, just turn on the calculator, give the power of your CPU and GPU the price of electricity in your area and see that it is not worth it at all.

Again, what I did was for fun, not as a professional test, opinion or guide. It was more to show people why mining at home is not worth it, as I get a lot of questions on how to start mining Bitcoins (lol).

Mining cryptocurrency at home using non-professional equipment can be an enticing idea, but whether it’s worth it depends on several factors, including the specific cryptocurrency you want to mine, your equipment, your electricity costs, and your long-term goals. Here are some considerations:

- Equipment: Non-professional equipment, like regular gaming GPUs or CPUs, may not be as efficient as specialized mining hardware (ASICs or GPUs designed for mining). Mining with such equipment might yield lower hash rates and consume more power.

- Cryptocurrency Choice: Some cryptocurrencies are more profitable to mine than others, depending on their current market value and the mining difficulty. Popular cryptocurrencies like Bitcoin are often out of reach for home miners due to their high difficulty levels, making it difficult to earn a profit.

- Electricity Costs: Electricity is a significant factor in mining profitability. If your electricity costs are high, it can eat into your mining profits. You’ll need to calculate whether your earnings from mining exceed your electricity costs.

- Network Difficulty: Cryptocurrency networks adjust their mining difficulty regularly to maintain a consistent block time. As more miners join the network, it becomes harder to mine, reducing your chances of finding a block and earning rewards.

- Long-Term Outlook: The cryptocurrency market can be highly volatile. Your potential earnings from mining may fluctuate along with the market. It’s important to consider your long-term financial goals and whether mining aligns with them.

- Noise and Heat: Mining equipment can be noisy and generate a lot of heat. You’ll need to consider the impact on your living environment and whether it’s worth the disruption.

- Initial Investment: Setting up a mining rig requires an initial investment in hardware and infrastructure. You’ll need to calculate how long it will take to recoup these costs.

- Technical Expertise: Mining can be technically challenging. You’ll need to maintain and troubleshoot your equipment, keep it cool, and handle software configurations.

In summary, while it’s possible to mine cryptocurrency at home with non-professional equipment, it’s rarely as profitable as using specialized hardware in a data center or a mining farm. To determine if it’s worth it for you, you should carefully evaluate the factors mentioned above, conduct cost-benefit analyses, and be aware of the risks involved. Additionally, consider the potential impact on your daily life, as mining can be noisy and generate heat. If you’re new to mining, it may also be worthwhile to start small and learn about the process before making a significant investment.

People can still make money from cryptocurrencies in various ways beyond mining, as mining has become less profitable for individuals in domestic settings. Here are some alternative ways to earn money with cryptocurrencies:

- Buying and Holding (HODLing): This is one of the most common strategies. You purchase cryptocurrencies and hold onto them with the expectation that their value will increase over time. Many investors have profited from the long-term appreciation of cryptocurrencies like Bitcoin and Ethereum.

- Trading: Cryptocurrency trading involves buying and selling assets on various exchanges to profit from price fluctuations. Traders can use technical and fundamental analysis to make informed decisions. Day trading, swing trading, and arbitrage trading are some common trading strategies.

- Staking: Some cryptocurrencies offer staking, where you lock up a certain amount of coins to support the network’s operations. In return, you earn staking rewards, typically paid in the same cryptocurrency. Staking can provide a passive income stream.

- DeFi (Decentralized Finance): DeFi platforms allow users to lend, borrow, and earn interest on their cryptocurrency holdings. Yield farming, liquidity provision, and lending are some ways to generate income in DeFi. However, DeFi can be high-risk and requires careful research.

- Dividend Coins: Some cryptocurrencies offer dividend-like payouts, where you receive tokens as a reward for holding and staking them. These tokens may represent a share of the project’s profits or network fees.

- Participating in ICOs/IEOs: Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs) are fundraising methods for new cryptocurrency projects. Participating in these can be profitable if you invest in projects that succeed.

- Freelancing and Earning in Crypto: Some freelancers and service providers accept cryptocurrencies as payment for their services. This can be a way to earn and accumulate cryptocurrency.

- Airdrops and Forks: Occasionally, cryptocurrency projects distribute free tokens to existing holders or spin off new cryptocurrencies through forks. Participating in these events can lead to unexpected gains.

- Affiliate Programs: Some cryptocurrency-related businesses offer affiliate programs that reward you for referring customers or users to their platforms.

- Education and Content Creation: If you have expertise in cryptocurrencies, you can create educational content, blogs, videos, or courses. You can monetize your content through ads, sponsorships, and affiliate marketing.

- Developing or Investing in Projects: Some individuals get involved in cryptocurrency development or invest in early-stage blockchain projects that show promise.

- Crypto Jobs: The blockchain and cryptocurrency industry is expanding rapidly, creating job opportunities in areas like development, marketing, customer support, and more. You can earn a traditional salary in cryptocurrency-related roles.

It’s important to note that the cryptocurrency market is highly volatile and speculative. Make sure to do thorough research and consider your risk tolerance before getting involved in any of these activities. Diversifying your cryptocurrency investments and staying informed about market trends are essential for success in this space.

Well, and remember, an investment in cryptocurrencies to be profitable must have an equity contribution and not $10 but several to several thousand. So if you already have savings, have built up a financial cushion and additionally have free money to invest, then you still need knowledge and you can start.

This week on that computer I used Xmrig tool and HashVault mining pool. I choose Monero (RandomX), Masari (CryptoNight Fast) and Conceal (here I used XMR-Stack for CryptoNight GPU).

Hardware details:

- GPU: MSI Radeon RX 6750 XT Mech 2x OC 12GB DDR6

- CPU: AMD Ryzen 7 5700X 3.4GHz

- RAM: Kingston Fury Beast DDR4 32 GB 3200MHz CL16

Other useful links:

Here are some screenshots:

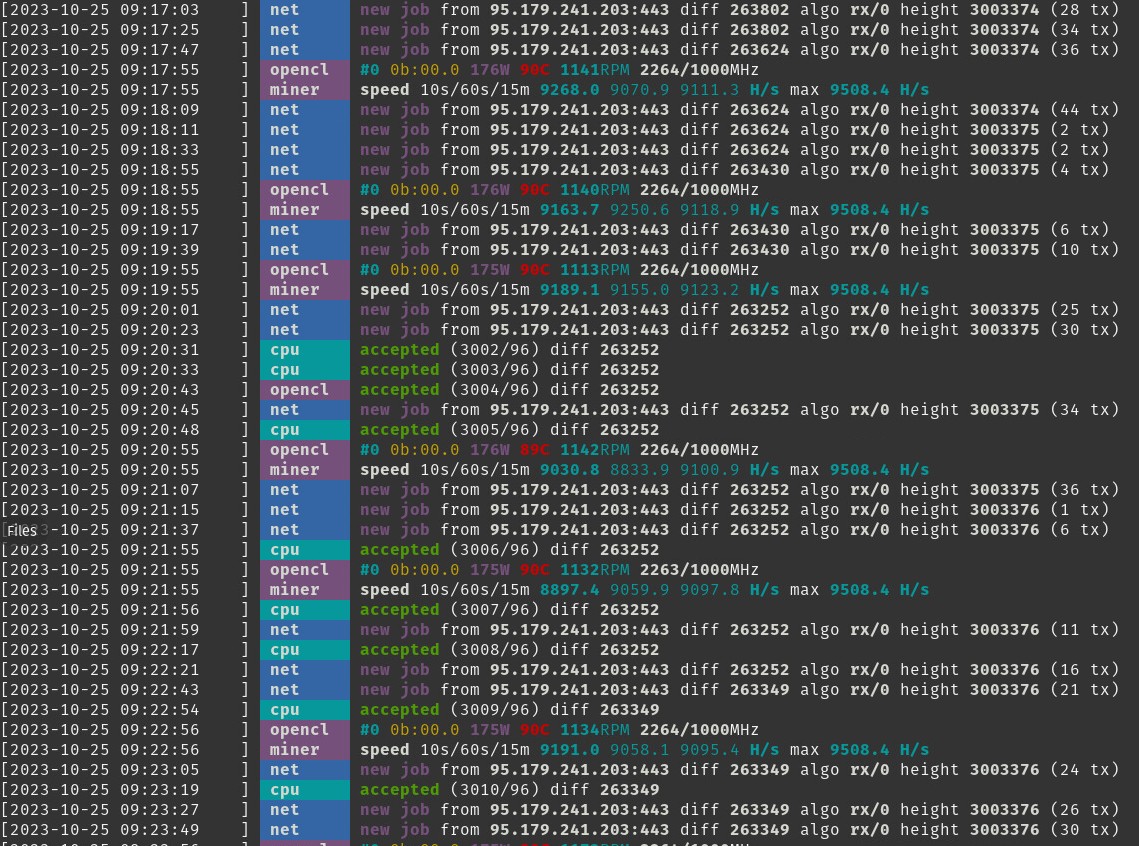

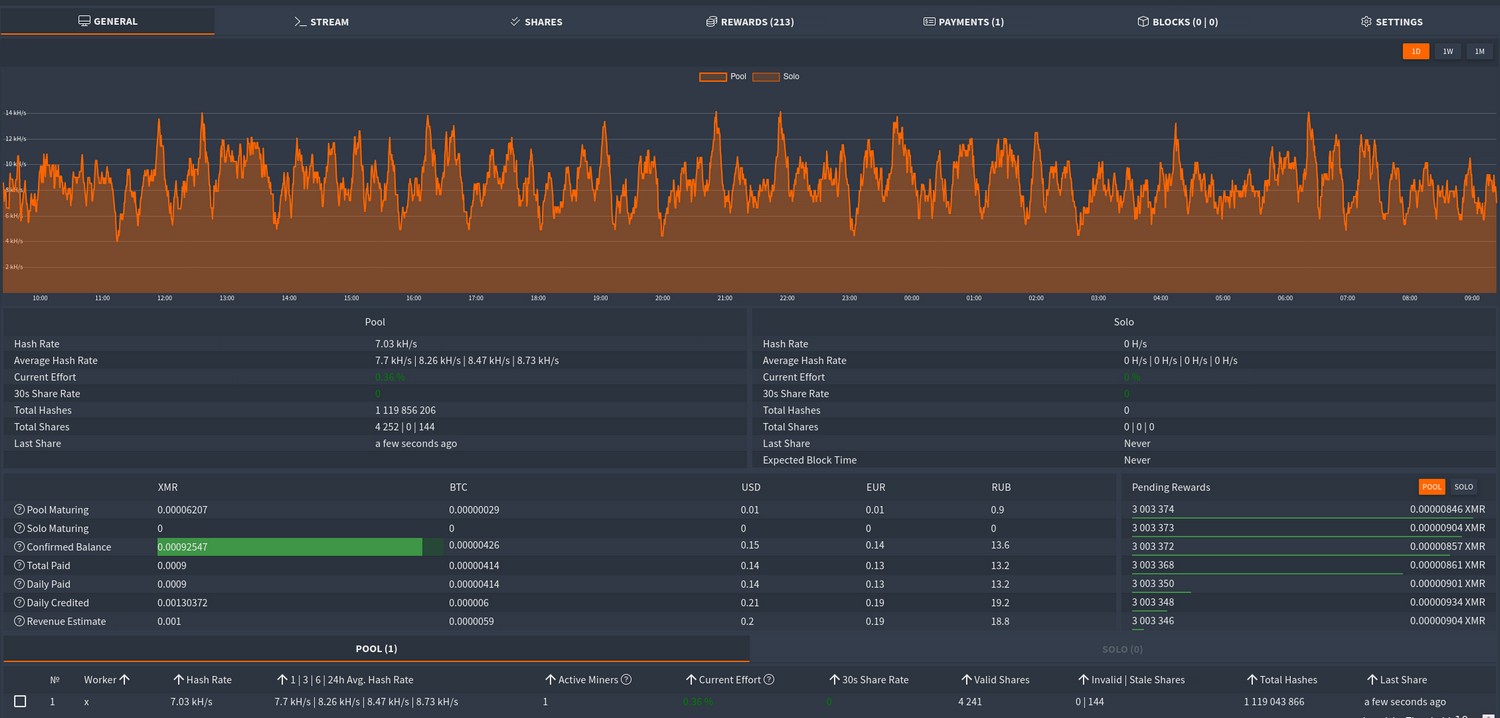

Xmrig in action

Amazing Hash Rate around 8 kH/s. It ran from 23 Oct 13:40 to 25 Oct 11:40. Payments: 0.0018 XMR (0.29 USD). If someone tells you to mine Monero instead of Bitcoin at home PC, do not do it.

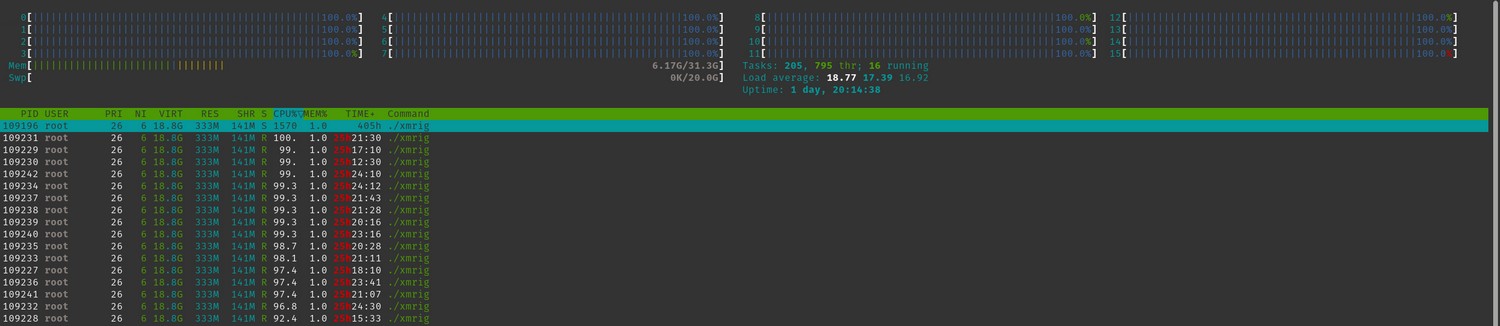

Busy CPU (stats from htop)

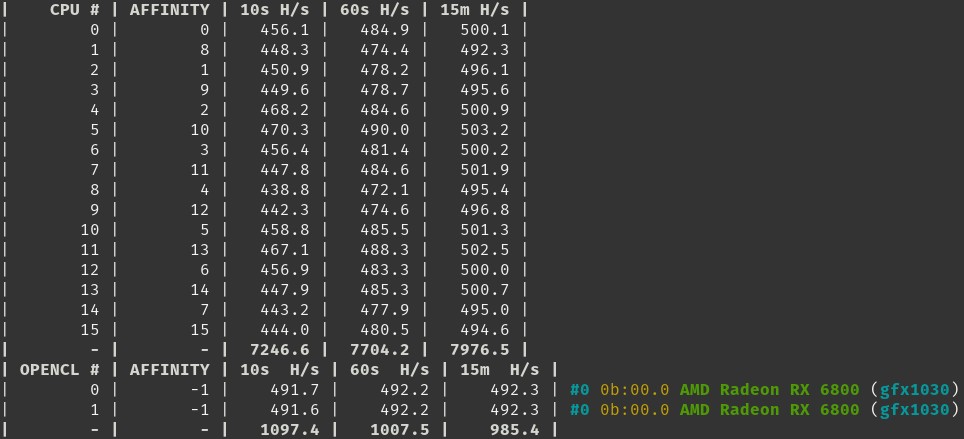

Hash Rate for CPU and GPU

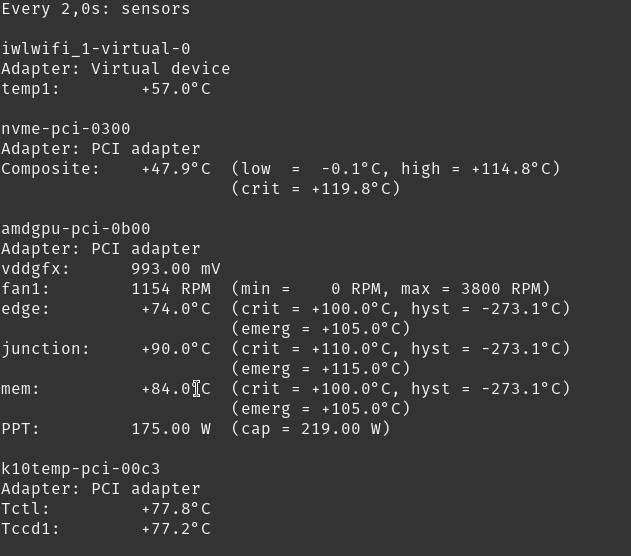

Check temperatures using watch -n 2 'sensors'

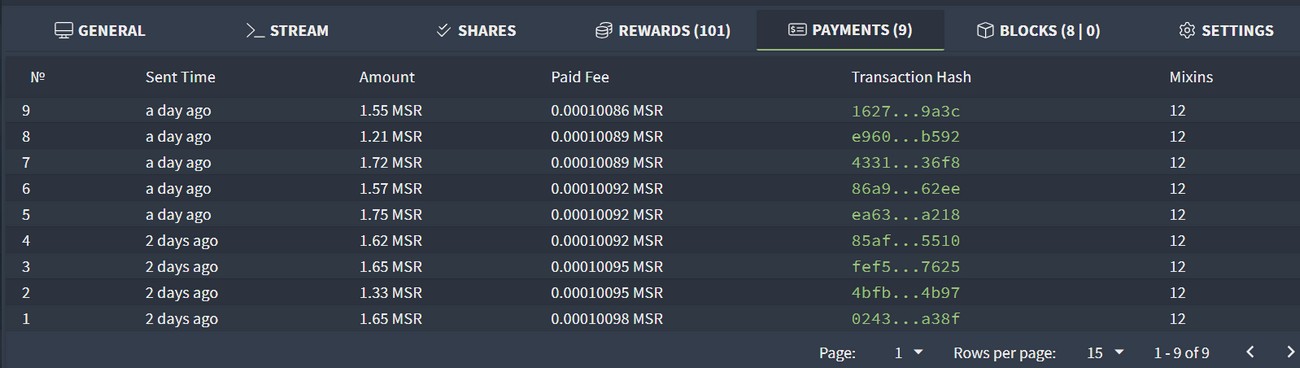

With Masari it was easier because the difficulty is lower.

Thanks to that I have around 0.1 USD. I hope that in the future 1 MSR will be worth 1,000 USD. Of course that will never happen, have you ever heard of Masari? Have you not? Neither have I. It ran from 25 October 12:00 to 26 October 7:40.

About Conceal I can show nothing as I just turn it on, and turned off after some time because its only GPU and the one I had was just shitty.

Electricity was free :) In general, it was not worth it. That was obvious, but why not do stupid things in your spare time to relax from hacking, cracking, working, thinking…

If cryptocurrency mining experts happen to come across this post, take it with a pinch of salt, I’m not trying to discourage anyone, I know some things are obvious and my fun is no great proof of anything. The main message is to check, calculate, read, discuss, test, prepare PoC for everything first and then spend millions on graphics cards and other fancy hardware. Nothing comes for free, and cryptocurrency miners know this best. Everything has to be achieved through consistent work. Unless you win the lottery.

Cool experience to configure everything on Pop OS! Linux, install drivers, tools, change configuration and see how it works. Now that I have everything configured, it is a good moment to test how such a configuration would work by cracking some hashes using Hashcat :) I will certainly describe it.

I was actually preparing this computer for hash cracking and dictionary attacks and before I started that someone said, let’s mine cryptocurrencies, it’s more interesting than hash cracking. Opinions in the office were divided.